An extensive utility undergrounding campaign funded by taxpayer dollars is well underway by city officials, staff, and hired legal and finance consultants targeting a November 2018 ballot measure.

The urgent move to underground city power poles has become a concerning and controversial issue for many reasons but primarily because it requires our city to take on substantial long-term debt by either taxing ourselves (property assessment tax), or increasing the local sales tax, or possibly both.

While the final initiative is still in progress, there is growing concern that the city is moving at record speed on the issue and failing to listen to its residents and prove that their information is entirely accurate and factual. This concerns LBCHAT and it should concern every property owner and resident too.

Here are some concerns expressed by residents (in no particular order) and some facts on the utility undergrounding initiative:

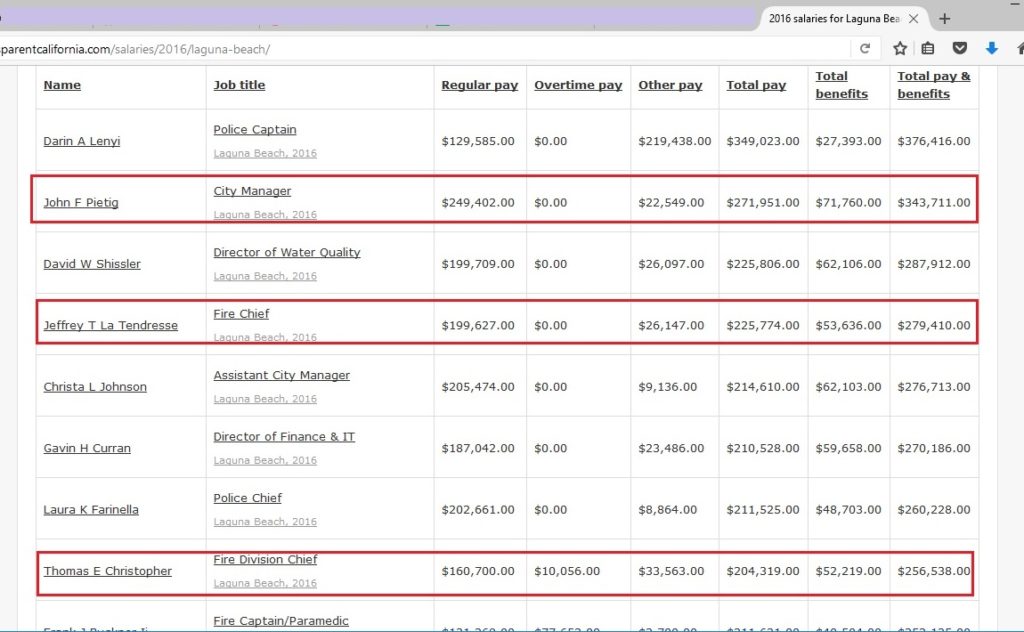

Fact: In March 2017, the City created a new Undergrounding Manager position at $230,000 per year. This hire will be in place 18 months prior to our opportunity to even vote for or against the initiative in November 2018 and will cost us about $345,000 annually. The City estimates over 6 1/2 years and possibly $10M spent before construction would even begin on undergrounding due to planning, engineering and approvals. Click here for UM job description and salary pdf.

Concern: The city appears to be moving forward as if Laguna voters have already approved the measure.

Fact: Campaign consultants were hired to conduct surveys crafted to support the initiative costing approximately $240,000. First survey results did not provide the support expected so a second survey was approved by City Council and is currently in progress. In addition, records are showing that nearly $30,000 was spent on TV advertising on CNN and Fox News stations through Cox Cable.

Concerns: The campaign outreach messages are fear-based and have has outraged some Laguna residents. Many survey participants have called the surveys bogus and blatantly obvious that they were created to produce the results the city intended to support the measure.

Fact: Laguna fire history: Contrary to what residents may be hearing during this recent urgent undergrounding movement by the city, the fact is that there have been no major fires caused by utility poles in Laguna Beach. The devastating 1993 fire was caused by arson. Laguna like many other cities in California falls under the high-fire danger umbrella. This is one reason why all utility companies state-wide are already abiding by and implementing strict fire safety regulations for electrical distribution systems.

Concerns: Residents felt safe with their fire departments performance and now have concerns due to the city fire fear promotions. Why has the city not promoted UU before now since the big fire they refer to happened in 1993?

Fact: Fire safety issues have been addressed in light of recent fires and California’s drought conditions. In December of 2017 the California Public Utilities Commission (CPUC) ordered all utilities to implement new fire safety measures for electrical distribution systems in high-risk areas. The CPUC and Cal Fire created a “Fire-Threat Map” where stricter fire safety regulations are being implemented, including some in Laguna in Tier 2 (high) and Tier 3 (highest) areas, and especially along Laguna Canyon Road. These regulations create significant new fire prevention rules for utility poles and wires, and frequent monitoring and inspection of all utility poles, including immediate correction of safety hazards in high fire threat areas, correction of non-immediate fire risks in Tier 3 and 2 areas within 6 months and 12 months, respectively, and major new rules for vegetation management. Click to view Fire Map Report here. These safety measures will sharply reduce the proposed risks.

Concerns: Why are we rushing to underground in proposed evacuation areas rather than allowing SCE to comply with the new regulations? If SC Edison fails to comply and meets the new regulations, its quite possible they could be legally required to underground the utilities at their own costs.

Fact: The urban parts of Laguna Beach (downtown and residential zones along PCH) were excluded from the CPUC Fire Threat Map because they have low vegetation fuel density, very low continuity, and a high degree of access for fire suppression forces. They are deemed low risk for a fire to grow out of control and based on this the CPUC rejected the City’s urging to designate its downtown urban areas as a high risk zone.

Concerns: Why is the City is insisting on undergrounding utility poles in these areas using the “evacuation routes” they have arbitrarily created? All neighborhood streets become evacuation routes so why not address all poles citywide? Fallen trees, light poles and parked cars provide as much obstruction in an evacuation as does a fallen power line. We can’t remove all trees because they might possibly catch fire and obstruct roadways. 90 percent of all fires are human caused (cigarettes, campfires and arson) and electrical transmission fires causing widespread damage are an extremely low percentage of all fires.

Fact: The City Underground Sub Committee City leaders and staff actually traveled to the CPUC in San Fransisco to present the argument for moving Laguna into a high-risk category. Click here.

Concerns: Residents are publicly complaining that as a result of the City’s fire and fear-tactic actions, their homeowner and fire insurance rates have increased and some policies dropped as insurance companies no longer want to insure homes in our city. This backlash from the fire danger promotion may cause substantial increase in insurance rates and possibly cancellations of coverage for our area.

Fact: Laguna Canyon Road is a State owned Right of Way, and is the responsibility of the California Department of Transportation (Caltrans). They are currently planning its widening and will pay for the removal of poles and overhead wires. Caltrans already underground their utilities at Big Bend in 2016 due to concern’s of vehicle safety.

Concerns: Why do Laguna homeowners and residents need to spend millions funding a 30 year bond and adding 1% sales tax when SCE and SDG&E has annual funds available to underground utilities and they can lobby the California Public Utilities Commission (CPUC) for additional funding. Why would our city burden us with this type of long-term debt when in fact overhead utilities most likely will be obsolete in next 10-20 years. If the poles and wires are scheduled to come down is the city’s proposal just to to secure more tax revenue forever by adding the $1% sales tax of undirected funds? When it’s not deemed necessary any longer for undergrounding the sales tax stays in place until voters vote it out. The city will never revisit this and concerns are that it will continue along with our other tax dollars and go towards the Employee Pension Fund and other City Council whims.

Fact: Many residential neighborhoods have already paid tens of thousands of dollars to underground their own neighborhoods with their own money. Many neighborhoods still cannot afford to form assessment district and costs to underground the utilities in their neighborhoods. Some local assessment districts are still paying: Coast Royal, Agate/Glenneyre, Woods Cove, Diamond/Crestview, Ruby Catalina to just name a few. In the Diamond street area the average assessment was $66,000, and Agate/Glenneyre was $54,000.

Concerns: Some of these neighborhood undergrounding’s were on so called “evacuation routes.” Should they now be strapped with paying other neighborhoods to be underground in arbitrary evacuation routes? Neighborhoods still without underground utilities will still need to pay too underground their own neighborhoods and other “evacuation routes” utilities. This personal debt is going to quite possible bankrupt many on fixed incomes or make it difficult or impossible to live in Laguna any longer.

Fact: Revenue resources: The City has determined that the only solution to under grounding utilities is by asking taxpayers to shoulder the majority of the financial burden.

Concerns: The city has not done the proper due-diligence in exploring and working effectively with SCE or other entities to share the burden even though several utility companies and Cal Trans are stockholders in the main evacuation routes. It doesn’t appear that the City has considered leveraging its own revenues to support a revenue bond or looked at the possibility of using Measure LL, the street lighting fund, or the $6.2 million in the City’s disaster contingency fund which could support a substantial debt towards undergrounding.

Fact: Our City annual budget is increasing each year.

Concerns: The City seems to be getting comfortable with a growing annual budget. Some residents feel its growing too rapidly and yet problems are rising and city services and quality of life is deteriorating. Many say its time our city leaders live within its means, stop spending like trust funders, make better use of discretionary expenditures and use existing budgeted tax dollars to underground the utilities at a rate we can afford. Assessing residents for 30+ years on their property taxes bills that are no longer tax deductible under the new federal tax law if they exceed $10,000 will have an impact for sure. Raising our sales tax also has negative and long-term impacts. There is no control over where the tax dollars are to be spent.

Fact: Fire and police support UU. Both of these public safety employee groups strive to do their jobs to the best of their abilities and part of this involves looking at related risks. It is with the best of intentions that they endorse lowering risks in our community and their opinion is important to us.

Concerns: Keep in mind that they are also part of a city government system that expects to be supported when decisions are made at the highest levels. There appears to be a difference of opinion as to what is desired vs necessary in regards to undergrounding and funding. Why haven’t these public safety departments bought this forward prior to 2017 and demanded something be done if in fact undergrounding poles is so dangerous and necessary?

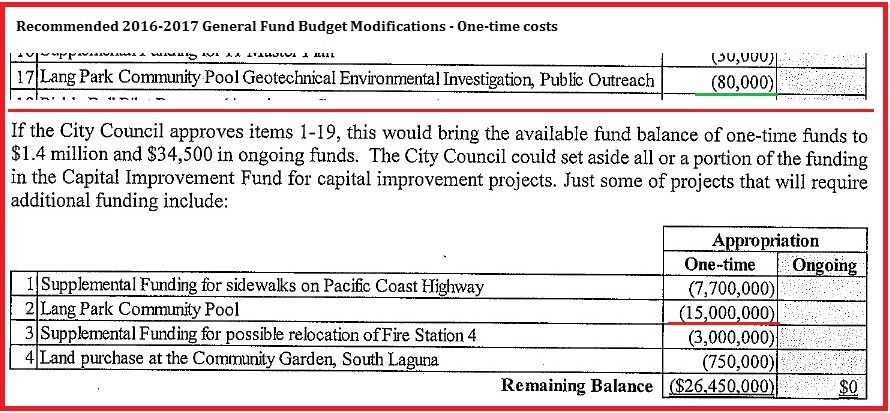

Fact: In the City’s capital improvement plan, over $30M is allocated to items like fire station remodel ($6M), community pool ($15M!!!) and sidewalks on PCH ($9.7M) which is a state highway.

Concerns: If undergounding utilities is so essential to our safety, why is a community pool prioritized as a capital improvement over undergrounding? Adding numerous staff over the last 3 years has added to our City’s payroll and hugh unfunded pension liabilities. It is projected that the costs of the City employees health insurance plan is expected to increase by 18%. Other questionable spending is the purchase of $3 million in new vehicles in under 3 years, replacing low mileage vehicles and spending millions of dollars purchasing real estate that is was not considered necessary. How can we sustain such budget expenditures?

Note: We hope this information has been helpful to you. Other concerns and facts will be added as they are shared with us. If you have additional concerns and facts on this topic, please send them to us for possible inclusion.

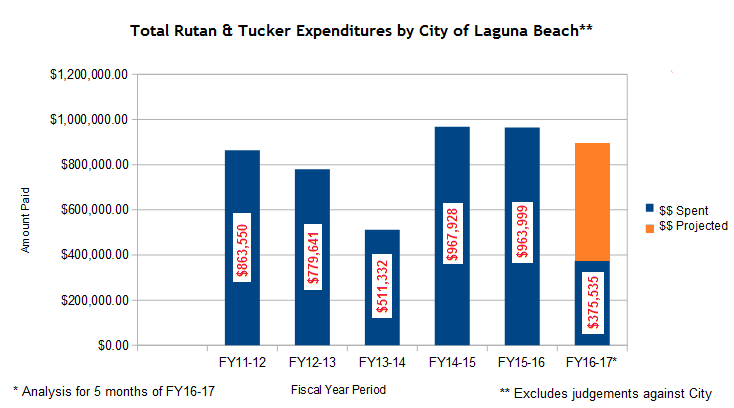

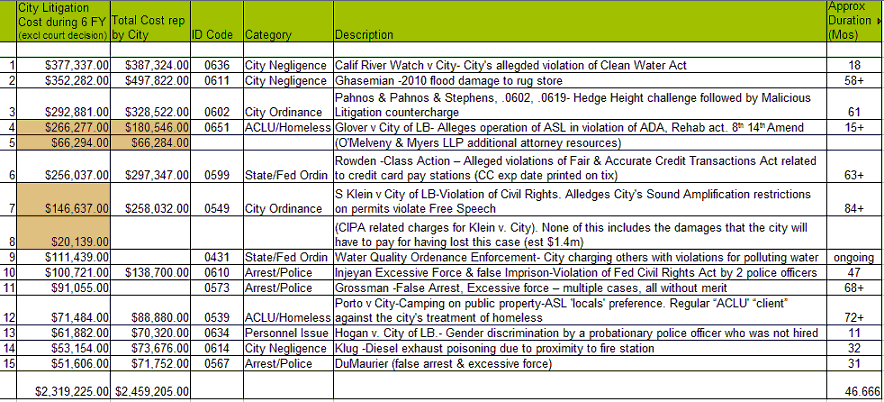

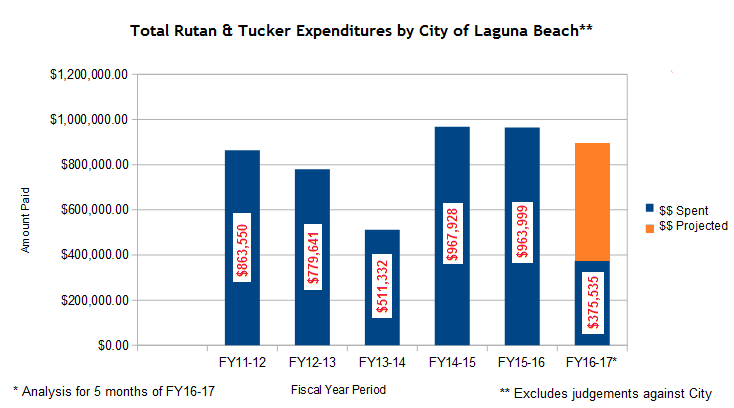

LBCHAT focuses on city government accountability and transparency matters related to city business activities, city representatives, city management, escalating legal and consultant budgets, the overall increase in annual city spending and of course tax increases. We encourage voters to become more knowledgeable before casting their votes on in the November election.

We have attached several documents obtained from the city addressing undergrounding for your review and will be adding others as they become available to us. Click here:

The Independent Review Team 11-21-17 (“IRT Report”)

Community Survey And Ballot Measure Advisory 12-05-17

Bond Counsel Consultant Special Tax 12-06-17

Financial Advisors for Ballot Measure 01-09-18

Consultant Agreement Pre-election 01-10-18

Undergrounding Master Plan Presentation 02-06-18

City Undergrounding Campaign Spending 2018

Two local groups have cropped up in support or opposition to the UU measure. We encourage our subscribers to review their positions and better understand facts and concerns. They are:

S.T.O.P. www.stoptaxingourproperty.com

Underground Laguna Now! www.undergroundlagunanow.org

Here are more links that provide information on the Utility Undergrounding:

http://stunewslaguna.com/archives/letters-a-obituaries-archive

https://www.lagunabeachindy.com/guest-column-103/

https://www.youtube.com/watch?v=2b3ttqYDwF0&sns=em

Get Off The Grid! – Undergrounding Guest Opinion Article

Fire Risks and Undergrounding – Guest Article

STOP Ad Placed in LB Indy

Should Power lines Be Underground? Article